Shocking but true, about 70% of customers renewed their policy with the same company for at least four years, and just under half have never compared rates from other carriers. New Jersey insurance shoppers can cut their rates by nearly $716 a year, but they don’t invest the time required to go online and compare rates.

The recommended way to find the cheapest price for auto insurance rates in Newark is to do a yearly price comparison from insurance carriers in New Jersey.

The recommended way to find the cheapest price for auto insurance rates in Newark is to do a yearly price comparison from insurance carriers in New Jersey.

- Step 1: Take a few minutes and learn about what is in your policy and the things you can change to keep rates down. Many factors that drive up the price like speeding tickets, accidents and a negative credit score can be eliminated by making minor changes in your lifestyle. This article provides tips to find cheap rates and earn a bigger discount.

- Step 2: Quote rates from independent agents, exclusive agents, and direct companies. Exclusive and direct companies can only give prices from a single company like GEICO or Allstate, while independent agencies can quote rates from multiple sources. Compare rates

- Step 3: Compare the price quotes to your current policy to see if a cheaper price is available. If you find a better price and decide to switch, make sure the effective date of the new policy is the same as the expiration date of the old one.

- Step 4: Tell your current agent or company to cancel your current car insurance policy. Submit any necessary down payment along with the completed application for your new policy. Once the application is submitted, put the certificate verifying coverage in an easily accessible location.

One piece of advice is that you’ll want to make sure you compare the same physical damage deductibles and liability limits on each quote request and and to get quotes from as many companies as feasibly possible. Doing this enables an apples-to-apples comparison and the most accurate and complete price analysis.

If you have coverage now, you will most likely be able to cut your premiums using this strategy. Buying the lowest cost policy in Newark is not as hard as you may think. But New Jersey consumers do need to know how insurance companies market on the web and use it to find better rates.

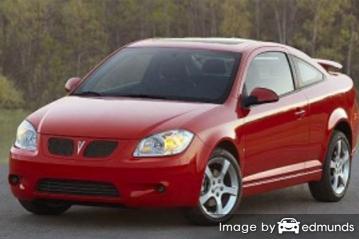

The most recommended method to compare car insurance company rates for Pontiac G5 insurance in Newark is to take advantage of the fact auto insurance companies will pay a fee to compare rate quotes. To start a quote, the only thing you need to do is spend a couple of minutes providing details such as if you’re married, if it has an anti-theft system, the ages of drivers, and if your license is active. That rating information is instantly sent to many different companies and you receive quotes instantly.

To compare multiple company cheaper Pontiac G5 insurance rates now, click here and find out if lower rates are available in Newark.

The companies shown below are ready to provide free rate quotes in Newark, NJ. If your goal is to find the cheapest car insurance in Newark, it’s a good idea that you click on several of them to get the most affordable price.

Why you need to buy car insurance

Despite the high cost of buying insurance for a Pontiac G5 in Newark, buying car insurance is required in New Jersey but it also protects you in many ways.

- Almost all states have compulsory liability insurance requirements which means the state requires specific limits of liability protection if you want to drive legally. In New Jersey these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

- If you bought your G5 with a loan, almost every bank will stipulate that you have physical damage coverage to guarantee loan repayment. If you cancel or allow the policy to lapse, the bank or lender will purchase a policy for your Pontiac for a lot more money and force you to pay much more than you were paying before.

- Car insurance protects both your assets and your Pontiac. Insurance will pay for many types of medical costs that are the result of an accident. Liability coverage, the one required by state law, will also pay attorney fees if anyone sues you for causing an accident. If your car is damaged in a storm or accident, comprehensive (other-than-collision) and collision coverage will pay all costs to repair after the deductible has been paid.

The benefits of having car insurance more than cancel out the cost, especially if you ever need it. Today the average American driver is wasting up to $750 every year so you should quote and compare rates at every policy renewal to make sure the price is not too high.

Verify you’re getting every discount

Car insurance is neither fun to buy or cheap, but there could be available discounts that you may not know about. Many of these discounts will be applied automatically when you complete an application, but some may not be applied and must be requested specifically prior to getting the savings. If you check and find you aren’t receiving every discount you qualify for, you’re paying more than you need to.

- Bundle and Save – If you can bundle your homeowners and auto insurance and insure them with the same company you could get a discount of up to 20% off your total G5 insurance premium.

- Discounts for Government Workers – Having worked for a branch of the government can earn a discount up to 10% with some car insurance companies.

- Clubs and Organizations – Being in a qualifying organization could earn you a nice discount on your next renewal.

- Fewer Miles Equal More Savings – Maintaining low annual mileage could qualify for cheaper car insurance rates.

- Senior Discount – If you qualify as a senior citizen, you are able to get better car insurance rates.

- Smart Student Discounts – Maintaining excellent grades could provide a savings of up to 20% or more. The good student discount can last up to age 25.

- One Accident Forgiven – This one isn’t a discount, but certain companies will let one accident slide before hitting you with a surcharge if your claims history is clear for a particular time prior to the accident.

- Passive Restraints and Air Bags – Cars that have air bags or automatic seat belts can qualify for discounts as much as 30%.

Just know that some credits don’t apply to the overall cost of the policy. The majority will only reduce individual premiums such as medical payments or collision. So even though they make it sound like you can get free auto insurance, that’s just not realistic.

A few of the larger companies and some of the discounts are shown below.

- State Farm discounts include passive restraint, student away at school, Drive Safe & Save, anti-theft, accident-free, defensive driving training, and good student.

- Esurance has discounts for safety device, Switch & Save, online quote, online shopper, anti-theft, homeowner, and DriveSense.

- Progressive offers discounts for online signing, multi-policy, homeowner, continuous coverage, good student, online quote discount, and multi-vehicle.

- Liberty Mutual policyholders can earn discounts including new move discount, new vehicle discount, safety features, new graduate, multi-policy, newly retired, and exclusive group savings.

- Auto-Owners Insurance includes discounts for paid in full, multiple vehicles, student away at school, group or association, anti-lock brakes, and teen driver.

- GEICO may include discounts for good student, seat belt use, anti-lock brakes, military active duty, and five-year accident-free.

If you need cheaper Newark auto insurance quotes, ask every insurance company what discounts are available to you. Some of the earlier mentioned discounts might not be offered on policies everywhere. For a list of companies with the best discounts in Newark, follow this link.

Ratings for New Jersey auto insurance companies

Buying coverage from the top car insurance provider can be challenging considering how many companies sell insurance in Newark. The rank data displayed below may help you choose which coverage providers to look at putting your business with.

| Company | Value | Customer Service | Claims | Customer Satisfaction | A.M Best Rating | Overall Score |

|---|---|---|---|---|---|---|

| Mercury Insurance | 87 | 96 | 100 | 87% | A+ | 93.4 |

| The Hartford | 88 | 96 | 91 | 93% | A+ | 92.6 |

| Progressive | 84 | 94 | 99 | 90% | A+ | 92.4 |

| Travelers | 84 | 93 | 100 | 87% | A++ | 92.3 |

| State Farm | 84 | 93 | 95 | 87% | A++ | 91 |

| Farmers Insurance | 87 | 92 | 90 | 85% | A | 90.6 |

| Safeco Insurance | 85 | 91 | 87 | 86% | A | 88.4 |

| USAA | 71 | 93 | 98 | 87% | A++ | 88 |

| GEICO | 73 | 93 | 95 | 85% | A++ | 87.1 |

| 21st Century | 85 | 85 | 91 | 89% | A | 86.9 |

| Liberty Mutual | 72 | 91 | 97 | 83% | A | 86.4 |

| AAA Insurance | 85 | 85 | 88 | 86% | A | 85.8 |

| Nationwide | 71 | 90 | 93 | 83% | A+ | 84.9 |

| Allstate | 69 | 92 | 92 | 83% | A+ | 84.4 |

| American Family | 77 | 96 | 80 | 85% | A | 83.8 |

| Esurance | 70 | 80 | 89 | 77% | A+ | 79.2 |

| Compare Rates Now Go | ||||||

Data Source: Insure.com Best Car Insurance Companies