Astonishing but true, the vast majority of auto insurance customers have been with the same company for over three years, and almost half have never shopped around. The average driver in New Jersey could save themselves nearly $700 a year by just comparing quotes, but most tend to underestimate how much they could save if they switch to a new company.

Astonishing but true, the vast majority of auto insurance customers have been with the same company for over three years, and almost half have never shopped around. The average driver in New Jersey could save themselves nearly $700 a year by just comparing quotes, but most tend to underestimate how much they could save if they switch to a new company.

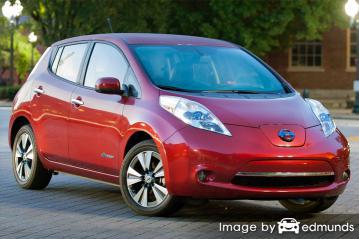

If you want to save money, the best way to get the cheapest Nissan Leaf insurance is to annually compare prices from insurance carriers that sell auto insurance in Newark. You can compare rates by completing these steps.

- First, get a basic knowledge of how your policy works and the measures you can take to keep rates down. Many rating criteria that result in higher rates such as multiple speeding tickets and a poor credit rating can be remedied by paying attention to minor details. This article gives the details to get low prices and find overlooked discounts.

- Second, compare rates from direct, independent, and exclusive agents. Direct companies and exclusive agencies can only give rate quotes from one company like GEICO or Allstate, while independent agents can provide rate quotes from many different companies.

- Third, compare the price quotes to your current policy and determine if there is any savings. If you find better rates and buy the policy, make sure the effective date of the new policy is the same as the expiration date of the old one.

One thing to remember is to compare the same coverage limits and deductibles on each quote request and and to get rates from as many companies as feasibly possible. This provides a level playing field and a thorough selection of prices.

The best way we recommend to get rate comparisons for Nissan Leaf insurance in Newark is to realize almost all companies allow for online access to provide you with a free rate quote. The one thing you need to do is provide the companies a bit of rating information like your credit rating estimate, daily mileage, if you went to college, and if it has an anti-theft system. That rating information gets sent immediately to multiple top-rated companies and they provide comparison quotes instantly.

To check Nissan Leaf insurance prices now, click here and enter your zip code.

The providers in the list below provide comparison quotes in New Jersey. If you wish to find cheap car insurance in New Jersey, it’s highly recommended you visit several of them in order to get a fair rate comparison.

Insurance in New Jersey serves several purposes

Even though it can be expensive, paying for insurance is most likely required but also gives you several important benefits.

- Most states have mandatory insurance requirements which means state laws require a minimum amount of liability insurance coverage if you drive a vehicle. In New Jersey these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

- If you bought your Nissan Leaf with a loan, it’s guaranteed your bank will require you to have full coverage to ensure the loan is repaid in case of a total loss. If you cancel or allow the policy to lapse, the lender will be forced to insure your Nissan for a much higher rate and force you to reimburse them for the much more expensive policy.

- Insurance protects not only your vehicle but also your financial assets. Insurance will also pay for hospital and medical expenses for you, your passengers, and anyone else injured in an accident. Liability coverage will also pay attorney fees if anyone sues you for causing an accident. If mother nature or an accident damages your car, comprehensive and collision coverage will cover the repair costs.

The benefits of insuring your Leaf outweigh the cost, especially for larger claims. The average driver in America overpays as much as $869 every year so smart consumers compare quotes at every renewal to ensure rates are inline.

Informed Consumers Know How to Find Insurance Cheaper

Many things are part of the calculation when you get your auto insurance bill. Some of the criteria are obvious such as traffic violations, although others are more transparent like your vehicle usage or your commute time. The best way to find cheaper insurance is to take a look at a few of the rating criteria that go into determining your policy premiums. If you have a feel for what controls the rates you pay, this empowers consumers to make smart changes that could help you find lower insurance prices.

The following are a few of the “ingredients” used by companies to determine your rate level.

- Vocation reflects on premiums – Occupational choices like military personnel, airline pilots, and miners generally pay higher average rates attributed to stressful work requirements and long work days. Conversely, careers such as scientists, engineers and the unemployed generally pay rates lower than average.

- Don’t buy extra policy coverages that aren’t used – There are many add-on coverages that you can get tricked into buying if you aren’t diligent. Coverages like rental car coverage, towing coverage, and motor club memberships may be costing you every month. They may sound like good ideas when discussing your needs, but if you don’t need them get rid of them and save.

- Save money by having multiple policies – Some insurance companies give better rates to policyholders who carry more than one policy such as combining an auto and homeowners policy. Even if you’re getting this discount drivers will still want to compare other Newark Leaf insurance rates to ensure the best deal. You may still be able to find lower rates even if you have your coverage with different companies

- Coverage lapses raise insurance rates – Going without insurance will be a fast way to increase your insurance rates. In addition to paying higher rates, being ticketed for driving with no insurance will get you a hefty fine and possibly a revoked license.

-

Insurance loss data for a Nissan Leaf – Companies analyze historical claim data when they calculate premium prices for each model. Models that the data shows to have increased claim numbers or amounts will have higher rates.

The information below illustrates the insurance loss data used by companies for Nissan Leaf vehicles. For each policy coverage, the claim amount for all vehicles, as a total average, is set at 100. Numbers below 100 suggest a positive loss record, while percentages above 100 point to more losses or larger claims.

Nissan Leaf Insurance Claim Statistics Make and Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury Nissan Leaf Electric 89 84 45 83 64 76 BETTERAVERAGEWORSEStatistics Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Do you qualify for discounts?

Car insurance companies do not list all discounts in a way that’s easy to find, so we researched a few of the more common in addition to some of the lesser obvious ways to save on car insurance.

- Auto/Home Discount – If you insure your home and vehicles with the same company they may give you a discount of approximately 10% to 15%.

- Student in College – College-age children who are attending college and won’t have access to an insured vehicle could qualify for this discount.

- Anti-theft System – Anti-theft and alarm system equipped vehicles are less likely to be stolen and can earn a small discount on your policy.

- Discount for New Cars – Buying a new car instead of a used Leaf can cost up to 25% less because new vehicles have to meet stringent safety requirements.

- Good Grades Discount – Being a good student can get you a discount of up to 25%. Many companies even apply the discount to college students up until you turn 25.

- Safe Driver Discounts – Insureds who avoid accidents can get discounts for up to 45% lower rates than drivers with accidents.

- Home Ownership Discount – Just owning your own home may trigger a policy discount on car insurance since owning and maintaining a home means you have a higher level of financial diligence.

One thing to note about discounts is that many deductions do not apply to the overall cost of the policy. Most only apply to the cost of specific coverages such as comp or med pay. So even though it sounds like you would end up receiving a 100% discount, it just doesn’t work that way.

The best car insurance companies and their possible discounts include:

- State Farm includes discounts for accident-free, good driver, passive restraint, good student, and Drive Safe & Save.

- Farmers Insurance has discounts for bundle discounts, multi-car, alternative fuel, youthful driver, and electronic funds transfer.

- Progressive offers discounts including multi-policy, continuous coverage, homeowner, online quote discount, multi-vehicle, and good student.

- GEICO policyholders can earn discounts including daytime running lights, five-year accident-free, good student, defensive driver, multi-policy, multi-vehicle, and seat belt use.

- Auto-Owners Insurance may offer discounts for safe vehicle, student away at school, paperless, mature driver, multi-policy, good student, and group or association.

- The Hartford has savings for driver training, anti-theft, vehicle fuel type, defensive driver, good student, air bag, and bundle.

- Farm Bureau offers discounts for good student, safe driver, multi-policy, renewal discount, multi-vehicle, and youthful driver.

- USAA discounts include multi-vehicle, defensive driver, multi-policy, new vehicle, and vehicle storage.

It’s a good idea to ask every prospective company which discounts you may be entitled to. Discounts may not be offered in your area. To choose car insurance companies that have a full spectrum of discounts in Newark, click here.

Auto insurance is available from agents near you

A small number of people still prefer to sit down with an agent and we recommend doing that Agents can make sure you are properly covered and give you someone to call. One of the great benefits of comparing rate quotes online is you can get the lowest rates but still work with a licensed agent.

Upon completion of this short form, your insurance coverage information gets sent to agents in your area who can give free rate quotes for your auto insurance coverage. You never need to even leave your home since rate quotes are delivered immediately to your email address. If for some reason you want to compare prices from a specific auto insurance provider, don’t hesitate to go to their quote page and complete a quote there.

Selecting a insurance company requires more thought than just a cheap price quote. Get answers to these questions too.

- Will high miles depreciate repair valuations?

- Can you contact them at any time?

- Is the quote a firm price?

- Do they have any clout with companies to ensure a fair claim settlement?

- Are there any discounts for paying up front?

Different types of Newark car insurance agents

If you’re trying to find a good insurance agency, you must know there are a couple types of insurance agents that you can select. Auto insurance agencies are considered either independent (non-exclusive) or exclusive. Either one can insure your vehicles, but it is important to understand the difference between them because it can influence the selection process.

Exclusive Insurance Agencies

Agents that choose to be exclusive normally can only provide a single company’s rates and examples are State Farm, Allstate and AAA. Exclusive agents cannot shop your coverage around so you might not find the best rates. Exclusive agents are highly trained on the products they sell which helps overcome the inability to quote other rates.

Shown below are exclusive insurance agents in Newark who can help you get price quotes.

Farmers Insurance: Anthony Pugliese

217 Chestnut St – Newark, NJ 07105 – (973) 536-2060 – View Map

Farmers Insurance – Anthony Pugliese

41 Wilson Ave – Newark, NJ 07105 – (973) 732-2105 – View Map

State Farm Insurance

360 Chestnut St – Newark, NJ 07105 – (800) 701-5909 – View Map

Independent Agencies or Brokers

Independent insurance agents do not work for one specific company and that gives them the ability to insure with an assortment of companies depending on which coverage is best. If they quote lower rates, they simply move the coverage in-house and that require little work on your part.

If you need cheaper auto insurance rates, we recommend you contact at a minimum one independent agency so that you can do a thorough price comparison.

The following are independent insurance agencies in Newark who can help you get rate quotes.

Atlantis Agency

177 Adams St – Newark, NJ 07105 – (973) 466-9090 – View Map

Te Freuler

274 Chestnut St – Newark, NJ 07105 – (973) 274-0500 – View Map

METROPLUS INSURANCE AGENCY-BELLEVILLE

338 Washington Ave – Belleville, NJ 07109 – (973) 759-8291 – View Map

Auto insurance savings summarized

When getting Newark car insurance quotes online, never skimp on coverage in order to save money. In many instances, an insured cut comprehensive coverage or liability limits and learned later they didn’t purchase enough coverage. Your objective should be to find the BEST coverage for the lowest price, but do not sacrifice coverage to save money.

We covered many tips how you can compare Nissan Leaf insurance rates in Newark. The key concept to understand is the more price quotes you have, the better your chances of lowering your car insurance rates. You may even discover the lowest rates are with a small mutual company. Regional companies may only write in your state and offer lower car insurance rates than the large multi-state companies such as State Farm and Allstate.

Budget-friendly auto insurance in Newark is attainable on the web in addition to many Newark insurance agents, and you should compare rates from both to have the best chance of lowering rates. There are still a few companies who do not offer internet price quotes and these small insurance companies only sell coverage through local independent agencies.

For more information, feel free to visit the articles below:

- How to shop for a safer car (Insurance Institute for Highway Safety)

- What Auto Insurance is Cheapest for a Nissan Altima in Newark? (FAQ)

- How Much is Newark Auto Insurance for a Ford Escape? (FAQ)

- Protecting Teens from Drunk Driving (Insurance Information Institute)

- Event Data Recorders FAQ (iihs.org)

- Medical Payments Coverage (Liberty Mutual)

- Five Mistakes to Avoid (Insurance Information Institute)